Real estate is still the best investment you can make today, millionaires say—here’s why

Illustration: The Oracles

Billionaire Andrew Carnegie famously said that 90% of millionaires got their wealth by investing in real estate. We wanted to know: Is this still true? Is investing in real estate still a good idea?

According to these nine Advisors in The Oracles, who made millions by investing in real estate, the answer is a resounding yes.

1. ‘Owning made me rich.’

.1569937633559.jpg?)

“Buying real estate has made me rich — mostly through necessity, not by design. I bought my first itty-bitty studio after scraping together a few bucks because I needed to live somewhere anyway.

A few years later, the studio doubled in value, giving me enough cash to plunk down 50% on a one-bedroom apartment. That soon rolled into a two-bedroom, then a three-bedroom, and finally landed me in my 10-room penthouse on Fifth Avenue in New York City.

Buying that tiny studio was the most important decision I made because it got me in the game.”

—Barbara Corcoran, founder of The Corcoran Group, podcast host of “Business Unusual,” judge on “Shark Tank”

2. ‘Residential properties can generate income year-round.’

“Investing in real estate is a great idea if you are in it for the long haul, not a quick return.

Your best bet is investing in residential properties that produce rental income year-round.Just make sure you understand all of the associated legal fees and are prepared for unexpected costs.”

—Bethenny Frankel, entrepreneur, philanthropist, founder of Skinnygirl and BStrong. Follow her on Instagram

3. ‘The right investment will continue to appreciate.’

“Real estate is real, and it’s always a good idea to put your money in real assets. But let me be clear: That doesn’t mean that all real estate is a good idea.

I only buy certain types of properties, generally multifamily ones in upscale locations that provide consistent cash flow and great potential for future appreciation.

I stay away from low-income areas and single-family homes. But even those assets are probably a better place to store your money than letting cash depreciate while sitting in the bank!”

—Grant Cardone, sales expert, New York Times best-selling author. Follow him on Facebook, Instagram and YouTube

4. ‘Buying is smarter than renting.’

“Most millionaires I know made more money from owning real estate than any other investment. Real estate consistently increases in value over time and outperforms other investments.

Plus, it isn’t as vulnerable to short-term fluctuations as the stock market. You get a tangible, usable asset, whether you’re renting out an apartment or commercial building for income or buying a home. And there can also be tax benefits for investment properties.

It’s always a good time to buy real estate. In fact, the real wealth is made by buying when everyone else is selling and vice versa. While many are talking about a recession, the market is strong, with increasing prices and transactions.

Renting a one-bedroom apartment can cost $5,000 a month in certain neighborhoods today, yet you can buy a $1 million house with just $4,000 a month in mortgage payments. And the rate is fixed for 30 years — the best kind of rent control.

So why would you rent? Besides, if you rent your property to someone else, you can cover your mortgage or better.”

—Peter Hernandez, president of the Western Region at Douglas Elliman, founder and president of Teles Properties

5. ‘You get six-figure tax breaks.’

“Real estate has incredible tax benefits. In certain situations, you don’t have to pay taxes on your gains from investment properties. You can also get a $250,000 tax break as an individual and $500,000 as a married couple.

The wealthiest people collect property the way they used to collect cars. Interest rates are low, prices have fallen, and you don’t have to tie up a lot of cash in the investment.

At the same time, more people are choosing to rent instead of own. You can have a lucrative rental property using other peoples’ money to cover the mortgage, taxes, and upkeep. With sites like Vrbo and Airbnb, you can also find short-term renters to subsidize your overhead.

While I suggest diversifying your investments, there is no better place to park your money than brick-and-mortar investments you can live in and enjoy. When you invest in your surroundings, you invest in yourself!”

—Holly Parker, founder and CEO of The Holly Parker Team at Douglas Elliman, award-winning broker who made over $8 billion in sales. Follow her on LinkedIn and Instagram

6. ‘It doesn’t tie up a lot of cash.’

“Real estate is a bankable asset, so you can always leverage it. It also doesn’t tie up a lot of cash. You can put down as little as 10% and use banks’ money to grow your investment. With such low interest rates, that’s like free money.

Unlike the stock market, where many factors are out of your control, your investment can’t disappear overnight. You can also build your wealth with excellent return rates and tax advantages.

The only people who lose money in real estate are those who bought at the height of the market and sold at the wrong time or took too much equity out of their home, leaving no profit margin when they sold it. It often takes time to see big appreciations, but if you hold on to your investment, you will.

—Dottie Herman, CEO of Douglas Elliman, a real estate brokerage empire with more than $27 billion in annual sales. Follow her on Facebook and Instagram

7. ‘Real estate offers unlimited options.’

.1569937471273.jpg?)

“Real estate is always a great investment because you have more options than with other types of investments.

If you invest in stocks, bonds, or a private offering, your success is completely dependent on factors outside of your control. At most, your options are to hold or sell. With real estate, you have unlimited options.

You can buy a house with the intent of flipping it, then rent it if the market turns south. If you buy a rental that appreciates in value significantly, you can sell it. Real estate can be refinanced, rehabbed, and rezoned. You can develop it, lease it, subdivide it, or add parcels to it.

These are just a few of your options. This flexibility is one of the reasons it has created more millionaires than any other asset class.”

—Daniel Lesniak, founder of Orange Line Living, broker at the Keri Shull Team, co-founder of real estate coaching business HyperFast Agent, author of “The HyperLocal, HyperFast Real Estate Agent”

8. ‘People will always need a place to live.’

“There’s an opportunity for greater and more consistent returns with real estate than with other investments. When a property is built, it’s because a group of people see a population large enough to justify it.

“The sheer number of new properties each year is a testament to the growing real estate market. Supply follows demand, and demand is continuing to rise. Populations almost never decrease, which is why the need for housing increases year over year.

The market for multifamily apartments in particular is growing. As apartments become more attractive, people are less likely to buy houses. With multifamily apartments, you continue to generate increasing income over time.

Once the property stabilizes, you can collect returns for your investors until you decide to sell. There’s also demand year-round wherever you go.”

—Robert Martinez, founder and CEO of Rockstar Capital, a real estate investment firm with over $330 million in assets under management, host of “The Apartment Rockstar” podcast. Follow him on YouTube and Instagram

9. ‘You can invest in land that produces income.’

“Many businesses come and go, but there’s one thing we’ll always need: land.

There’s an inherent demand for real estate, whether the land produces a product like coffee or is home to an apartment or retail space; so it will always be a good investment. No matter what kind of business you run, you need land.

Investing in real estate allows you to protect yourself and your wealth. While the real estate market has gone up and down, it has never declined over time. Compare that to when Wall Street collapsed or currencies that aren’t backed by anything tangible.

Over time, you will always get value from real estate that produces income — like a coffee farm, for example. Even better if you choose property with inherent value, such as a location in Times Square.”

—Marcello Arrambide, founder of Day Trading Academy, co-founder of SpeedUpTrader, a funding company for aspiring day traders. Follow him on LinkedIn

Join The Oracles, a mastermind group of the world’s leading entrepreneurs who share their success strategies to help others grow their businesses and build better lives. For more, follow The Oracles on Facebook and LinkedIn.

ARTICLE COURTESY OF ….. https://www.cnbc.com/world/?region=world

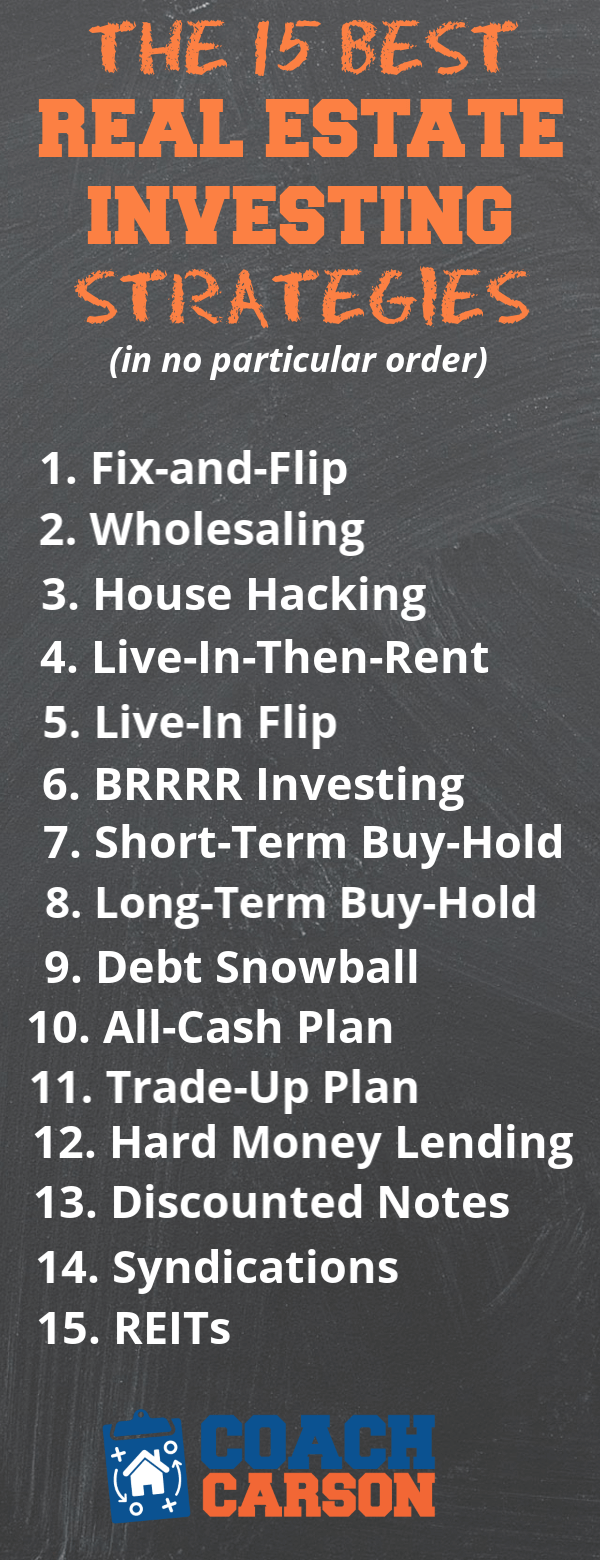

The 15 Best Real Estate Investing Strategies

By Chad Carson

Real estate investing is an I.D.E.A.L. investment. But the umbrella of real estate investing contains many different ways to make money (i.e. strategies). As a new investor, these numerous choices can be overwhelming.

So in the rest of this article, I will explain what I think are the 15 best real estate investing strategies. These strategies will give you a better idea of how to make money in real estate investing.

And hopefully, one or more strategies will be a good fit for you. If so, this article can provide the perfect starting point for your own real estate investing journey.

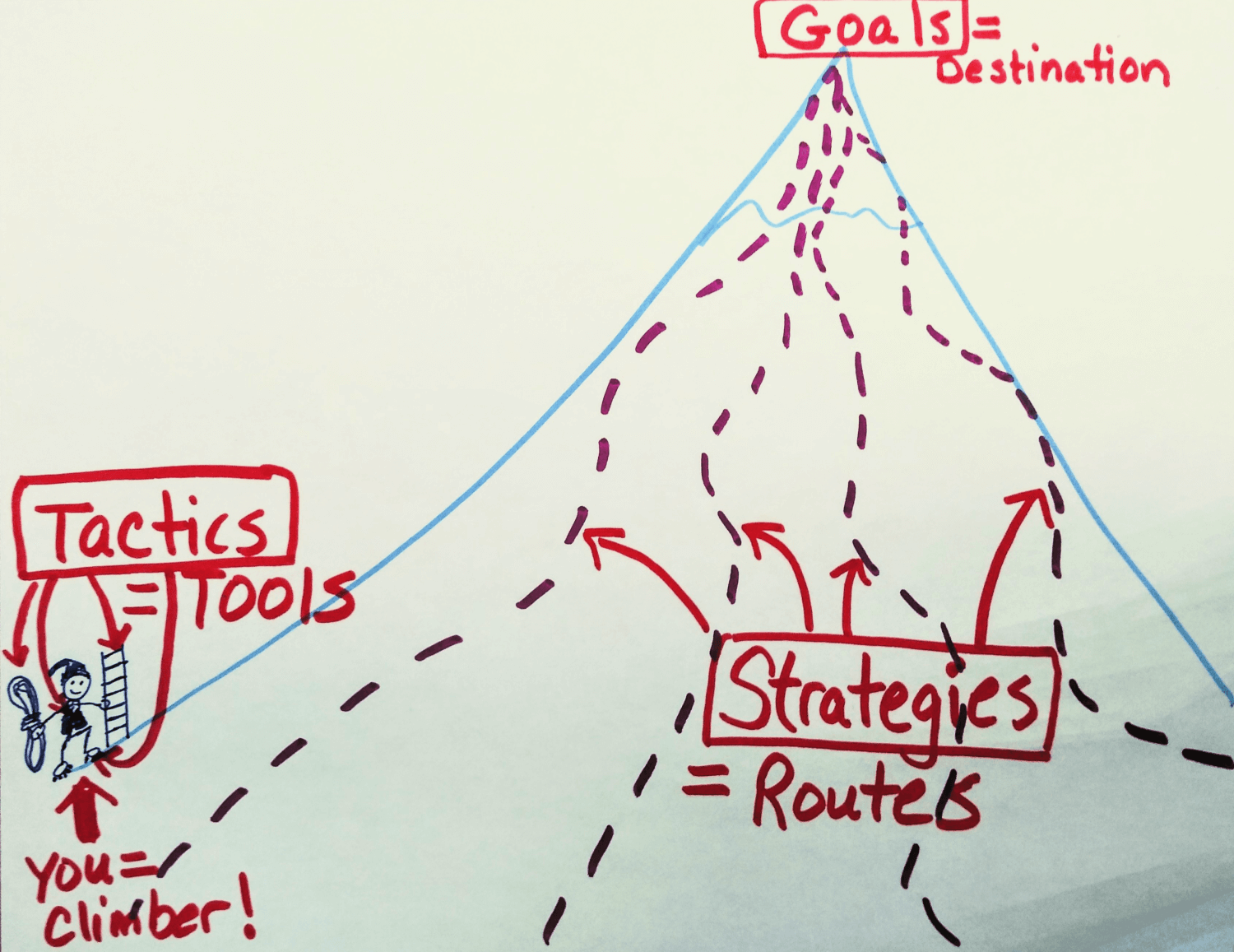

Let’s get started by learning the difference between goals, strategies, and tactics.

Real Estate Goals vs Strategies vs Tactics

You could look at real estate investing and wealth building as climbing a mountain. And of course, you are the courageous mountain climber!

The peak of the mountain is like your financial and life goals. And there are numerous milestones (or sub-goals) along the way.

Strategies are like plans for how to climb up the mountain in the first place. They are the routes that will take you towards the peak in the fastest AND safest manner.

And tactics are like the climbing tools (ropes, ladders, binoculars, etc) that help you actually climb up those routes.

I have many articles on real estate investing tactics, including analyzing your market, finding good deals, running the numbers, seller financing, negotiation techniques, and more.

But too many real estate investors get caught up in tactics without clarity on why they are using the tactics in the first place. Getting good at tactics without a strategy can simply make you better at hiking right off financial cliffs!

So I first recommend getting clear on basic real estate investing goals, like financial independence or a certain number of free and clear rental properties. Then get clear on one or two strategies that you like. After that, all of the tactics you learn will become much more useful.

Now let’s take a look at the real estate investing strategies themselves.

The Best Real Estate Investing Strategies

In my opinion, the following are the 15 best real estate investing strategies.

To make them easier to understand, I’ve divided each of these strategies into groups based on how they’re used. These groups include:

- Business strategies

- Starter strategies

- Wealth building strategies

- Debt strategies

- Passive strategies

I’ll now unpack and briefly explain each of these 15 strategies. When possible, I’ll provide links to other articles and resources to help you use each of these strategies if you’re interested.

Business Strategies

More businesses than investments, these strategies can generate income and replace your job. But you must be prepared to invest the upfront time and effort of a business start-up in order to make them work.

1. Fix-and-Flip

The Fix-and-Flip strategy is the business of finding properties that need work, doing the repairs, and reselling them at top price for a profit. If you’ve ever watched the flipping shows on HGTV, this is what they do!

I used this model for much of my early years in real estate in order to pay the bills and generate cash savings for future investments. It was not always easy, but the beautifully finished houses and the sometimes large chunks of cash were rewarding.

My favorite resources on this strategy are The Book on Flipping Houses and The Book on Estimating Rehab Costs by my friend J Scott.

2. Wholesaling

Wholesaling is the business of finding good deals on investment properties and then reselling them quickly for a small mark up. The crux of this business is being good at marketing and negotiating to find those good deals.

If you’re good at sales, you’ll like wholesaling. But if the idea of sales makes you cringe, I’d look for a different strategy.

I also began my real estate career doing a variation of this strategy called “bird-dogging.” I essentially hunted down deals for other more experienced investors. I then got paid whenever they bought a deal that I found.

My friend Brandon Turner published the free, Ultimate Beginner’s Guide to Real Estate Wholesaling.

Starter Strategies

These are my favorite, safest ways to get started in real estate investing. And in some cases with a little hard work, you can even get started with a small amount of cash.

3. House Hacking

House Hacking means living in a home that also produces income, like in a duplex, triplex, fourplex, or house with extra rentable space like a basement, guest house, or spare bedrooms. By renting out part of your residence, you can reduce your total housing costs.

House hacking is also an amazing strategy because you learn the landlord business while living at your rental. And once you are done living there, you can move out and transition the property to a long-term rental.

Check out why I love this strategy in The House Hacking Guide, which has step by step instructions and a case study of my first house hack.

4. Live-In-Then-Rent

Live-In-Then-Rent is simply living in a house that will eventually become a rental. This means the house must work as your home AND as an investment later on. But unlike house hacking, you don’t rent the property while you live there.

Doing this strategy a few times is a great way to build a small portfolio. And you don’t have to live next to your tenants like house hacking.

If you’d like to learn more, you can use my first live-in-then-rent as a case study.

5. Live-In-Flip

The Live-In Flip is a strategy where you buy and move into a home, fix it up, and wait two years or more to resell it for a profit. If you follow the IRS rules, you pay NO tax on the profit up to $250,000 for an individual or $500,000 for a couple filing jointly.

My friends Carl and Mindy Jenson from the blog 1500days.com used a few Live-In-Flips to amass savings of several hundred thousand dollars early in their careers! You can read their story in Getting Rich With the Live-In Flip.

6. BRRRR Investing

BRRRR stands for Buy-Remodel-Rent-Refinance-Repeat. When done carefully, it’s an excellent way to build a rental portfolio without running out of cash early in your investing career.

Essentially you look for fixer-upper properties that you can buy below their full value. You use short-term cash or financing to buy the property, and then after it’s fixed and stabilized, you refinance with a long-term mortgage. If done well, you can pull most or all of your original capital back out for the next deal.

My friends at Bigger Pockets have a lot of great information on BRRRR investing.

While I like this strategy, I think it’s best when used early on to first build your portfolio. Eventually, it’s smart to transition to lower leverage and lower risk approaches instead of constantly leveraging as much as possible. An example of an ideal transition strategy is the Rental Debt Snowball below.

Wealth Building Strategies

The focus of these core wealth building strategies is turning a small nest egg into a large amount of wealth. Real estate investing has long been an ideal vehicle for this purpose.

7. Short-Term Buy and Hold Rentals

This strategy involves buying and holding rental properties for relatively short periods of time – perhaps 1 to 5 years. Often the purpose of this strategy is to force property appreciation (aka add value) by remodelling, raising the rent, decreasing expenses, or all of those.

The short-term buy and hold strategy works very well for multi-unit apartment turn-around projects. It also works well for rentals in high priced, appreciating markets that don’t cash flow as well.

I share an example of one particular application of the Short-Term Buy and Hold Rental strategy in the Buy 3-Sell 2-Keep 1 Plan.

8. Long-Term Buy and Hold Rentals

This is the strategy of owning real estate with the intention of keeping it for the long haul. The benefits of this slow and steady (and very successful) strategy include rental income, tax shelter from depreciation expenses, amortization of loans, and price appreciation.

I continue to use this strategy, especially on my properties in the best locations. I like to keep these properties because they attract the best tenants, are the least hassle to manage, and tend to appreciate the most over time.

My friend Brandon Turner from Bigger Pockets has a great book called The Book on Rental Property Investing if you want to go deep on this subject. You can also read my article Landlording 101 to see how I manage my portfolio of buy and hold properties (even while traveling abroad!).

9. The Rental Debt Snowball Plan

The Rental Debt Snowball Plan is one of my favorite strategies to predictably build wealth, reduce risk, and eventually create an ongoing income stream from rental properties. It basically involves gathering all of the cash flow from your current rentals and any other sources, and then concentrating that cash flow to pay off one mortgage debt at a time.

The magic of this strategy is the speed that debt payoffs start to snowball (i.e. accelerate) over time. If you’d like to retire within 10-12 years or less, check out this Rental Debt Snowball case study.

10. The All-Cash Rental Plan

The All-Cash Rental Plan is similar to the Rental Debt Snowball Plan because it snowballs rental income for growth. But instead of using mortgages, you just save up cash and buy a rental property without any debt.

Some financial teachers like Dave Ramsey advocate this type of investing. It would be tough to get started with all cash investing in a high priced market, but in many areas, it’s still a great plan.

In the article Real Estate Investing While Overseas in the Military, my friend Rich Carey explained how he built a portfolio of 20+ rentals in Alabama without any debt.

11. The Trade-Up Plan

The Rental Trade-Up Plan is perfect for entrepreneurial investors willing to juggle a lot of moving parts. This strategy is a way to quickly build real estate wealth and income by moving from smaller to larger properties, typically using a technique called a 1031 tax-free exchange.

See this case study for an example of how the trade-up plan works.

Debt Strategies

These debt strategies put you into the profitable (and often passive) role of lender instead of an owner of real estate.

12. Hard Money Lending

Hard money lending is the strategy of making short-term loans to real estate investors who buy rentals or fix-and-flip properties. Usually, the loans involve high-interest rates, points (i.e. upfront fees), and lower loan to value ratios.

While the strategy can be very profitable, it also has large risks. If you have to take the properties back at foreclosure, you need to make sure you’re protected.

I recommend educating yourself well before doing hard money lending, beginning with Ian Ippolito’s free Hard Money Lending Guide. And if you’re very serious, you should consider paid education with my go-to teacher on the subject, Dyches Boddiford’s Hard Money Lending class.

13. Discounted Note Investing

Discounted note investing means creating or buying notes (i.e. real estate debt) at a discount to the note’s full value. Because of this margin of safety, you can create large returns and reduce your risk.

One form of Discounted Note Investing involves buying notes (typically those that are delinquent) from other owner financing sellers or from banks. This is a much more advanced strategy, so I recommend studying it carefully before jumping in. You can begin with note investor Dave Van Horn’s book Note Investing.

My experience with Discounted Note Investing came from creating my own notes. I sold some of my rental properties to my tenants using seller financing.

For example, I had approximately $70,000 invested in a property. I then sold the property to my tenant for the full value of $100,000. But instead of my tenant getting a loan at a bank, I became the bank. The buyer paid me $10,000, and I financed the $90,000 balance (i.e. received monthly payments of interest and principal).

While this is a profitable strategy, federal and state regulations like the Dodd-Frank Act have made it much more difficult for small investors to navigate. While there are a few exceptions, small investors must follow many of the same, expensive rules as large lenders. So, get help from your local attorney before beginning this strategy.

Passive Strategies

Although some of the passive strategies below still involve important upfront investment decisions, they require less day-to-day hassles than some of the prior strategies.

14. Syndications & Crowdfunding

Syndication is essentially pooling your money with other investors to buy real estate or make loans. It’s a way to invest in any of the other strategies mentioned above without having to put the deals together yourself. You invest your money with syndicators or general partners who find and manage deals for you (and they receive a fee).

Crowdfunding is a relatively new form of syndication investing where deal opportunities are marketed through online platforms like Peer Street (this is an affiliate link). Most require you to be an accredited investor, but you can sometimes begin investing with as little as $1,000 to $5,000 per investment.

I am beginning to explore some of these syndication deals myself, and one of my favorite sources of information is Ian Ippolito at theRealEstateCrowdFundingReview.com.

Although I put Syndication/Crowdfunding as a passive real estate investing strategy, this is bit misleading. Investing in syndications and crowdfunding CAN be very easy and passive, but successful investors with this strategy are still active.

These successful investors actively screen the sponsors, general partners, and deal opportunities before making an investment. In other words, they say “no” a lot more than they say “yes.” And that’s very different from passive index investing or even REIT investing where you make very few active decisions.

15. Real Estate Investing Trusts (REITs)

Real estate investment trusts (i.e. REITs) are very similar to a mutual fund. But instead of allowing you to own a piece of many stocks or bonds, these REITs allow you to own a piece of many commercial, income-producing properties.

And unlike most of the other investment strategies above, this strategy truly is passive once you buy it.

REITs are not my specialty, and they are not something I have invested in. But you can get a good introduction to REITs in Where Do REITs Fit in a Portfolio and When Is the Right Time to REIT?

Conclusion

You’ve now read through the 15 best real estate investing strategies. These are the different routes up the financial mountain using real estate. Each has its own pluses and minuses.

Keep in mind that most investors combine different strategies at different times. For example, you may begin with House Hacking, then transition to Long-Term Buy & Hold Rentals, and finally, do a few Fix-and-Flip deals on the side.

And also don’t worry if you try one strategy and realize it doesn’t work for you. Real estate investing is an entrepreneurial venture. Sometimes you have to experiment and try things that don’t work before you find your sweet spot.

Best of luck with your own real estate investing strategies!

ARTICLE COURTESY OF ….. https://www.coachcarson.com/

MORE GREAT FREE ADVICE LINKS ON HOW TO INVEST IN REAL ESTATE..

https://www.forbes.com/sites/jrose/2019/02/22/real-estate-investing-without-buying-property/#3dc3c02b71f5

https://www.investopedia.com/articles/mortgages-real-estate/08/buy-rental-property.asp

https://www.fool.com/millionacres/real-estate-investing/articles/9-best-ways-invest-real-estate/

https://www.investopedia.com/investing/simple-ways-invest-real-estate/

https://learn.roofstock.com/blog/real-estate-investing-tips-from-successful-investors

https://www.forbes.com/sites/davidgreene/2018/11/18/the-top-seven-traits-of-a-a-successful-real-estate-investor/#67084992378a

https://fundrise.com/education/blog-posts/the-most-important-questions-to-ask-before-you-invest-in-real-estate

https://tembomoney.com/learn/mortgage-acronyms-explained / how you can cover your mortgage or better

More Great Free Offers links

HubSpot Free HubSpot Trial.. Get access via this HubSpot link.. https://hubspot.sjv.io/c/2879020/1114366/12893

More Great Make Money Promotions

Earn 25% through referrals to Cuelinks..For more info click here.. https://clnk.in/kvN9

€50 added to your account when you use CurrencyFair to transfer money..only via this link.. https://www.currencyfair.com/rafland/?channel=R5QYF1

More Great Online Promotions / “(paid links)” .

Welcome to the Augusta Precious Metals Affiliate Program!

This is a SUPER time in the gold IRA niche. Gold IRAs are booming because consumers are worried about the economy and are actively searching for information on how to hedge.

This is an amazing high-profit affiliate program. We believe there will be a bull market for gold IRAs for the next three to six years. You’re getting into this at the right time.

We’ve seen exponential growth in the last year. This success is due mainly to our affiliate program and affiliates like you.

We have paid out millions and millions to affiliates so far. This has a lot to do with the power of our unique one-on-one web conference developed and often hosted by Devlyn Steele, our Harvard-trained economic analyst. Hall of fame quarterback Joe Montana, our corporate ambassador, closes your deal. That’s the level of service your leads get from Augusta.

How Much Money Can You Make with Augusta? You could realistically make $100,000+ in a month. Here’s how:

Avg. top 10 Affiliates trade amount = $229,260 Super-high commission rate = 10% $229,260 x 10% = $22,926 Based on these numbers , with just 5 conversions, you could make $100,000 in one month! Other Augusta affiliates are doing it. We realize the path to our own success begins with affiliates like you. We look forward to having you on the Augusta team. Let’s move some mountains together! Dont delay..Join now using this link.. https://apmaffiliates.com/apply/?ref=1520

Namecheap, we’re renowned for amazing deals that give you huge savings across our product range from domains & SSL certificates to Private Email & hosting packages..For more offers click this link… https://clnk.in/sW2F

Udacity is the world’s fastest, most efficient way to master the skills tech companies want.Learn online and advance your career with courses in programming, data science, artificial intelligence, digital marketing, and more.. For more offers click this link… https://clnk.in/sW28

Get paid for your great content at shareasale.com. Join here.. Find a sponsor for your web site. Let shareasale.com find sales leads for you. Only pay when it works! Drive more traffic to your online store using performance based marketing.. Learn how we can increase your sales, develop your brand, and generate interest in your site. Promote Your Online store.. Sign up via this link.. https://www.shareasale.com/r.cfm?b=40&u=2343799&m=47

HubSpot Landing Page Builder.. Get access via this HubSpot link.. https://hubspot.sjv.io/c/2879020/1084929/12893

HubSpot Email Marketing .. Get access via this HubSpot link.. https://hubspot.sjv.io/c/2879020/1001262/12893

HubSpot HubSpot for Startups .. Get access via this HubSpot link.. https://hubspot.sjv.io/c/2879020/1242445/12893

HubSpot CMS / Website Builder.. Get access via this HubSpot link.. https://hubspot.sjv.io/c/2879020/1001267/12893

Investment Offer

Hello..

I am the owner of my new website.. https://iigrowrich.com ..

I have a special offer for all you potential investors..I am offering a low price and therefore lower risk , to own part of , https://iigrowrich.com , and be part of a great journey into the future for all of us..

I am offering equity ownership in.. iigrowrich.com ..up to a maximum of 5%.. I can sell the equity in increments of 1% , so any investor can buy 1% or more , up to a maximum of 5%..each 1% costs $2250 ..

If we grow 5 or 10 times or more , than our present size , then you may get a return of 5 or 10 times or more on your investment..

If you are interested , please write to me at.. support@iigrowrich.com

Regards..Ted .. owner / founder.. https://iigrowrich.com ..

This design is wicked! You definitely know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

This really answered my problem, thank you!

I like this post, enjoyed this one appreciate it for putting up. “The difference between stupidity and genius is that genius has its limits.” by Albert Einstein.

I loved your blog.Really looking forward to read more. Will read on…

Awesome article post.Much thanks again.

I love surfing on your pleasant site